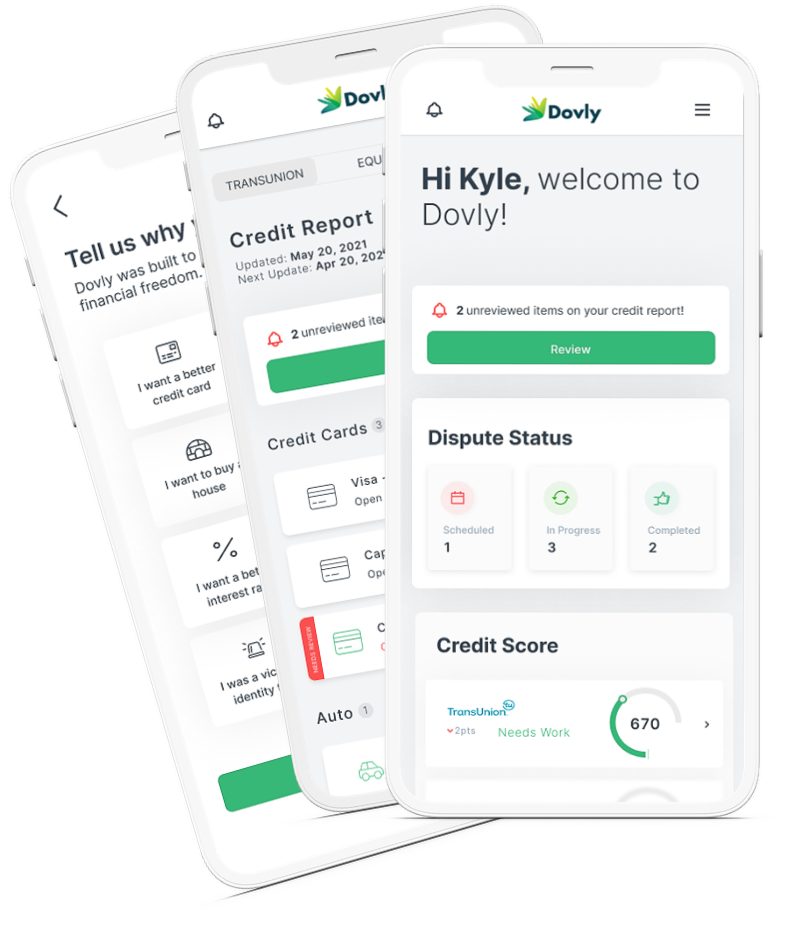

Dovly, a fintech company based in Scottsdale, has launched a free version of its automated credit repair platform as part of its strategy to make the app available to as many users as possible.

Dovly’s free version includes one credit dispute a month with TransUnion. The free option comes in addition to the company’s two paid products, which run at a monthly subscription of either $9.99 or $39.99. The paid options offer unlimited disputes with either TransUnion or all three credit bureaus, respectively.

Dovly CEO and co-founder Nirit Rubenstein told AZ Tech Beat that Dovly’s free version is perfect for anyone simply trying to improve their credit health. She also noted that Dovly is the only free, automated credit repair platform on the market.

“We really are trying to revolutionize the entire consumer credit landscape,” said Rubenstein. “There are no products out there today that do this. None.”

She added that even Dovly’s paid options are cheaper than anything else out there. Dovly is a third to a tenth lower than other price points, she said. Other credit repair companies often still send physical letters to dispute each claim. As a result, these companies are more expensive and take much longer to get results.

“Credit repair companies are the biggest scam of all,” Rubenstein said.

While there are credit monitoring companies like Credit Karma and Credit Sesame, Rubenstein said that Dovly’s secret sauce is its proprietary algorithm designed to automatically dispute credit problems. The algorithm also determines the best time to dispute customer claims in order to maximize success.

The company boasts that 92% of its customers see their credit scores increase by an average of 54 points.

Rubenstein co-founded Dovly in 2018 with Tedis Baboumian. The two met while working at a private equity firm specializing in credit repair. While there, Rubenstein noticed the brokenness of the credit repair system at the time and she also saw the large number of people who were being affected.

Rubenstein knew she had to get Baboumian on board to start her new company. He’s an expert in all things credit.

She said she thought to herself, “How do I get this guy’s brain into technology?”

As it turns out, she was successful.

“The first MVP was the productization of his brain,” Rubenstein said.

Rubenstein credits Karamvir Singh, Dovly’s Director of Engineering, with synthesizing all of Baboumian’s knowledge into one algorithm.

Dovly’s free version comes nearly three years after the company was founded because there is such a major cost to pulling credit reports. A free version of the platform didn’t make sense until this year.

Dovly’s had a big year so far, announcing in July a $3 million raise in bridge funding.

Rubenstein hopes that all of Dovly’s products will help consumers feel more confident in their credit scores.

“Consumers can sit back and relax,” said Rubenstein. “We do the work for you.”